Carey W. King and Josh D. Rhodes

Our economic system operates within intellectual, social, and physical constraints. Each of these constraints can feedback to affect the others. To produce more goods and services we have to 1) know how to produce them, 2) make them desirable, acceptable and affordable, and 3) have the required natural resources. The finite size of the Earth increasingly affects socioeconomic outcomes across the globe, including within the developed economies.

Ecologists, anthropologists, and systems scientists have anticipated this since the 1970s. However, the physical constraints on societal and economic organization and equality are largely unappreciated and misunderstood. This lack of understanding leads politicians to offer choices that do not span the feasible spectrum because they usually only envision improved social outcomes with more physical and economic growth. The consequence is that the pursuit of growth is prioritized over livelihoods. We could choose the opposite priority. The first step is understanding how the current economic system operates.

The economy is a complex system. Via individual and collective decisions, it changes and adapts to circumstances, physical constraints, and rules that we have created. Systems scientists and economists work to understand how multiple parts of our economy interact to both grow the economy and distribute the proceeds among people and different types of businesses.

The entire U.S. economy is so byzantine and affects so many people that it is difficult for any one individual to have a complete understanding, but we can draw conclusions and facilitate discussion by observing what is happening. In any case, no matter your politics, decisions that affect all 320 million citizens of the US deserve thoughtful analysis.

Donella Meadows, one of the mothers of system science, stated that “The best way to deduce a system’s purpose is to watch for a while to see how the system behaves. … Purposes are deduced from behavior, not from rhetoric or stated goals.”

The primary purpose of this article is to take Meadows’ advice to heart and examine some of the major long-term trends that define the purpose of our economy.

In today’s age of enhanced political rhetoric, it is more than important than ever that we contemplate Meadows’ insight. By observing economic outcomes and trends, we can define the purpose of our economic system, decide if we want it to change, and consider if and how it can realistically change. If the outcomes, and thus purpose, of our economy are not what we want, we should elect representatives, vote for rules, and make purchasing decisions that redefine the purpose.

One example, federal income and corporate taxes indicate how outcome-oriented thinking is markedly different than the discourse common among elected officials and the media. The U.S. Congress and President Trump just made substantial changes to the tax code via the Tax Cuts and Jobs Act of 2017 (TCJA). In general, the TCJA focused on lowering tax rates for different income brackets and corporations.

Executive branch officials and many analysts disagreed over whether the proposed tax rate changes will increase or decrease the total taxes paid by individuals within any given income bracket, and whether government debt will increase (most analysts think federal government debt will increase). Discussions regarding tax rates (% of income or profits as tax) and total tax (total dollars as tax) usually avoid that they are not the same. A systems approach could instead frame legislation along the lines of how much total tax lawmakers desire from corporation profits and respective income brackets, and then create a mechanism to change tax rates to achieve that outcome.

Needless to say, that was not the approach taken during the recent debate.

A few figures below outline some fundamental long-term trends that define important changes in our economy and help distinguish its “purpose” from its behavior. Per what is termed “Stein’s Law,” we must understand such trends “cannot go on forever” and that in response we must adapt our mindset and create policies to achieve realistic and compatible, rather than contradictory, expectations.

Some trends cannot go on forever because of physical and energetic constraints. To that end, mainstream economic current outlooks are well-aligned with the sentiment in this lyric from Texas balladeer Robert Earl Keen: “The road goes on forever, and the party never ends.”

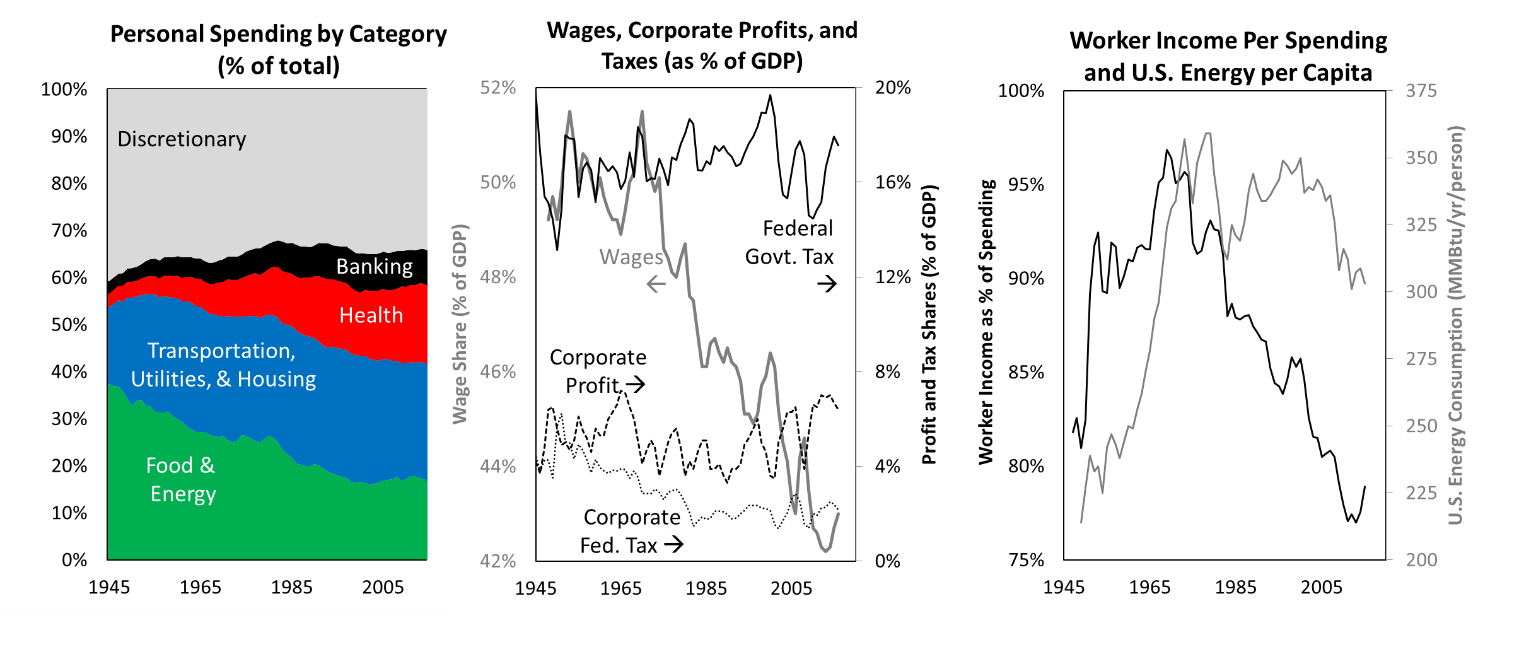

Consider the percentage of consumers’ spending via major categories (Figure 1). The major underlying trend is that the percentage of spending on food and energy declined from the end of World War II through 2002. This decline in the fraction of total spending on food and energy has been the defining economic trend since industrialization. That’s a big deal.

Over many decades, this trend coincided with increased energy consumption and opened up growth opportunities for spending on other goods and services such as housing, finance, and health care. But this trend could not continue forever. Energy and food will never become free, and no major spending category can account for zero or one-hundred percent of total spending. For the past 15 years or so, energy and food spending has been higher than in 2002.

Other notable spending trends are that the share of our spending on banking activities increased from less than 3% after World War II to more than 7% by the early 1990s. Meanwhile, the share of spending on health care has steadily increased to over 16% since 2009 as the population ages and puts increasing pressure on the young to support retiring Baby Boomers. These categories cut into discretionary spending, and that is why their growth is of such concern for family budgets.

| Figure 1. U.S. Personal Consumption Expenditures (PCE) as a percentage of spending category. The year 2002 marks the low point in the percentage of PCE spent on “food and energy”. [Data: Bureau of Economic Analysis, Table 2.3.5 describing annual Personal Consumption Expenditures.]

|

Figure 2. Wages as a share of GDP have been declining since the early 1970s, and corporate profits as a share of GDP are approximately constant over time. [Data: Wage share is compensation of employees divided by GDP (FRED data series W270RE1A156NBEA). Profit share is corporate profits including inventory adjustments divided by GDP (FRED data series W273RE1A156NBEA). Federal Govt. Tax share is Federal Receipts as Percent of Gross Domestic Product (FRED data series FYFRGDA188S). Corporate Federal Tax share is Tax Receipts on Corporate Income divided by GDP (FRED data series FCTAX).] | Figure 3. The average U.S. personal income has not kept up with total spending (e.g., spending is outpacing income as represented by the declining line trend) and has been supplemented increasingly with debt. [Data: Income is “compensation of employees” from FRED time series COE then divided by Personal Consumption Expenditures from BEA Table 2.3.5. Primary energy consumption per person per year uses data from Energy Information Administration Monthly Energy Review Table 1.1 (energy) and C1 (population).] |

A second trend shows that while business profits have maintained a steady share of approximately 5% of GDP since World War II, the share of GDP going to wages declined from near 50% during the three decades after World War II to 42% in 2013 (Figure 2). Federal tax revenue from corporations declined from 5% in the early 1950s to 2% in 1981, remaining near

2% since, even though federal government taxation has remained steady at or near 17% of GDP since World War II. Consider that if the federal government paid for all of today’s spending on health care, almost 100% of federal taxes would be required.

A third trend illustrates the impact of declining wage share from the second point. U.S. consumers have always spent more than their income by taking out loans (e.g., for example for home mortgages), but the trends before and after 1970 are different. Before 1970 workers’ incomes increased, allowing them to consume more but borrow less over time. Starting around 1970, this trend shifted to where consumers increasingly borrowed more to maintain consumption. After the 1970s, profits stayed high. Wages declined.

In observing the “behavior” of the U.S. economy, we present three broad statements concerning its “purpose”:

- First, the capabilities and purpose before and after the late 1960s/early 1970s are different.

There are good reasons to believe this time span separates a fundamental shift in economic structure because many major changes occurred during this time. Japan and Western Europe had largely recovered from rebuilding after World War II, and thus were becoming competitive with the U.S. After World War II the Bretton Woods agreement pegged the U.S. dollar to gold until President Nixon ended this physical linkage in 1971. The Clean Air Act (1970) and the Clean Water Act (1972) enacted major environmental enhancements to manage pollution problems that were overwhelming the environment and human well-being in many regions of the country. In 1970, the U.S. peaked in oil production rate, and in 1973-1974 the Arab Oil Embargo and jump in oil prices triggered a move to energy efficiency for the first time as the U.S. was forced to consider limited energy availability.

- Second, post-1970s, the purpose of the economy appears to be one that maintains a constant share of GDP for both corporate profits and government spending at the expense of allocating a declining share of GDP to workers. To wit: since 1981, federal taxes from corporations have remained near 2% of GDP.

This began a trend that continues today for businesses to seek lower labor and energy costs by more efficient and higher capacity utilization of capital. During the early- to mid-1980s, U.S. President Reagan and U.K. Prime Minister Thatcher symbolized and promoted this change. Think globalization. Efficient use of capital means you have to enable people and corporations that have money to move it around, globally if needed, at will. Automation of manufacturing, the “sharing economy” via ridesharing (Uber, Lyft, etc.) and home rentals (AirBnB, Homeaway, etc.), and automation of driving and mobility services via artificial intelligence are continuations of this trend to decrease wage share and maintain profits for those that own capital and businesses.

- Third, the decade of the 2000s might signal another time span separating economic eras. From the 1980s through the 2000s, the economy grew while accumulating debt and central banks continually lowered interest rates. After the 2000s, debt-burdened consumers have struggled to pay off debt, and thus the near-zero interest rates have not induced corporations to expand production for domestic consumption.

From 1980s to the early 2000s, food and energy costs continued to fall. Since 2002, the core costs of food and energy have not become cheaper for the average or median U.S. worker. The industrial world has never experienced a time such as the last decade when (1) food and energy costs are not declining, (2) debt is at such high levels, and (3) interest rates are near zero. We posit that that these factors are fundamentally interrelated.

This interrelatedness stems from feedback of information that govern the cyclical evolution of society over a few hundred years. Example feedbacks are how energy consumption affects

wealth and fertility decisions, fertility affects the size of the labor force, and the amount of labor affects wages. Historical pre-industrial societies experienced cycles of progress, stagnation, and decline before rebuilding. The industrial age is approximately two hundred years in. Many data points provide evidence that the U.S. today, and quite possibly the world overall, is experiencing the peak phase of an “industrial age” cycle.

So what should we do? The primary point of this commentary is that any proposed solutions should be systems-oriented and placed in the context of the major long-term trends such as those presented. The data presented in this article do not necessarily indicate failure of a specific economic policy. However, the important indicators presented in this article exhibited fundamental changes in trend after the 1970s as the U.S. adjusted to global events and constraints. Thus, it is a failure to ignore them. It is also a misleading at best, as in the TCJA of 2017, to promote a continuation of tax policies of the last 40 years (specifically decreasing corporate and income tax rates) and yet expect a complete reversal of outcomes, such as an increasing wage shares for workers. The 40-year record indicates these same policies have done the exact opposite.

Carey W. King is an assistant director at the University of Texas at Austin’s Energy Institute; Josh D. Rhodes is a research associate at the Energy Institute.